Indicators could be useful tools in trading when used appropriately and in conjunction with different forms of evaluation and risk administration methods. Here are some ways in which indicators can help traders:

Trend Identification: Indicators can help merchants determine the direction of price tendencies, whether or not they are bullish (rising prices) or bearish (falling prices). This data is crucial for trend-following strategies.

Confirmation of Trends: Indicators can affirm the presence of a pattern, providing further confidence in the course of price actions. This confirmation could be notably helpful for trend-following merchants.

Reversal Identification: Some indicators are designed to detect potential pattern reversals or adjustments in market sentiment. These indicators assist merchants establish points at which tendencies may be exhausted or reversing.

Momentum Assessment: Indicators measure the energy and momentum of price movements. This information is crucial for gauging the force behind worth developments and potential shifts in momentum.

Overbought and Oversold Conditions: Oscillators, such because the Relative Strength Index (RSI) and Stochastic Oscillator, assist identify overbought (potentially overvalued) and oversold (potentially undervalued) circumstances, which might sign potential reversals.

Volatility Measurement: Indicators like Bollinger Bands and Average True Range (ATR) present insights into market volatility. High volatility can current each alternatives and risks for merchants.

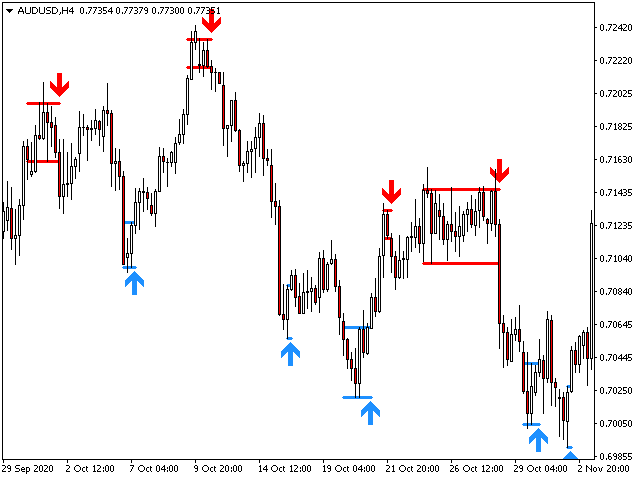

Support and Resistance Levels: Technical indicators can help merchants establish potential help (price levels the place buying interest is expected) and resistance (price levels the place promoting curiosity is expected) areas.

Timing of Trades: Indicators can assist traders in timing their trades by providing entry and exit signals primarily based on specific conditions or crossovers.

Risk Management: By using indicators to set stop-loss and take-profit levels, merchants can implement risk management strategies to limit potential losses and defend their capital.

Filtering Noise: Technical indicators might help filter out noise or short-term fluctuations in price knowledge, allowing merchants to concentrate on the more important value movements and tendencies.

Pattern Recognition: Some indicators, like moving averages and trendlines, can help traders establish chart patterns, such as head and shoulders, flags, and triangles, which can inform trading choices.

Objective Analysis: Indicators provide merchants with goal, data-driven information, decreasing the affect of emotions in trading selections.

While indicators could be priceless instruments, it's necessary to note that they aren't foolproof and shouldn't be relied upon exclusively. Here are Market Structure Indicator for using indicators effectively:

Combination with Other Analysis: Indicators are handiest when used at the side of different types of analysis, together with elementary evaluation, sentiment analysis, and value action analysis.

Adaptation to Market Conditions: Traders ought to choose indicators that align with the current market conditions and regulate their methods as market dynamics change.

Risk Management: Proper danger management, including setting stop-loss orders and managing place sizes, is essential for protecting capital.

Continuous Learning: Traders ought to constantly study and adapt their strategies based on changing market circumstances and their very own trading experiences.

Ultimately, the effectiveness of indicators in buying and selling is determined by a dealer's skill, experience, discipline, and the thoughtful integration of indicators into their total trading plan. Successful trading typically includes a mix of instruments and techniques, with indicators being only one part of the puzzle..